Tax Sale Purpose

The Delinquent Tax Sale is a method of collecting delinquent property taxes owed to the county, pursuant to South Carolina Code of Laws Title 12, Chapter 51, as amended. Delinquent tax notices are transferred to the Tax Collector by way of an Execution from the Treasurer. The Tax Collector must then follow a strict legal procedure of mailing notices (some certified, restricted delivery), physical posting of property, advertising in the local newspaper, and finally the sale of delinquent properties at public auction. The proceeds of this sale are used to pay property taxes owed.

Click here for Lexington County's website

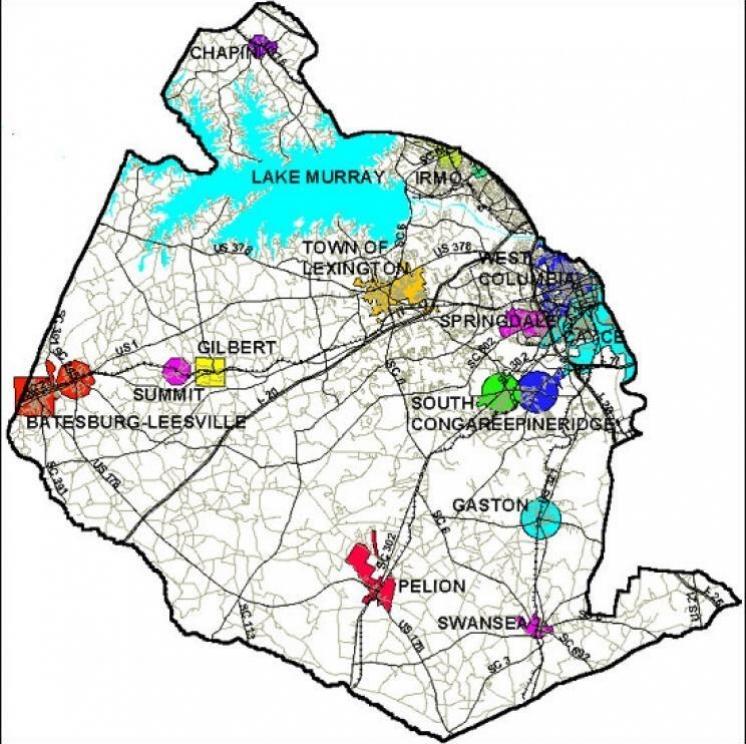

Location:

Lexington County Recreation Barr Road Sports Complex 213 Barr Road Lexington SC 29072

Date/Time:

Tax sale 2021 will be held December 6, 2021 beginning at 10:00 AM.

See the Lexington County website for more information about the procedures for registering and bidding requirements.